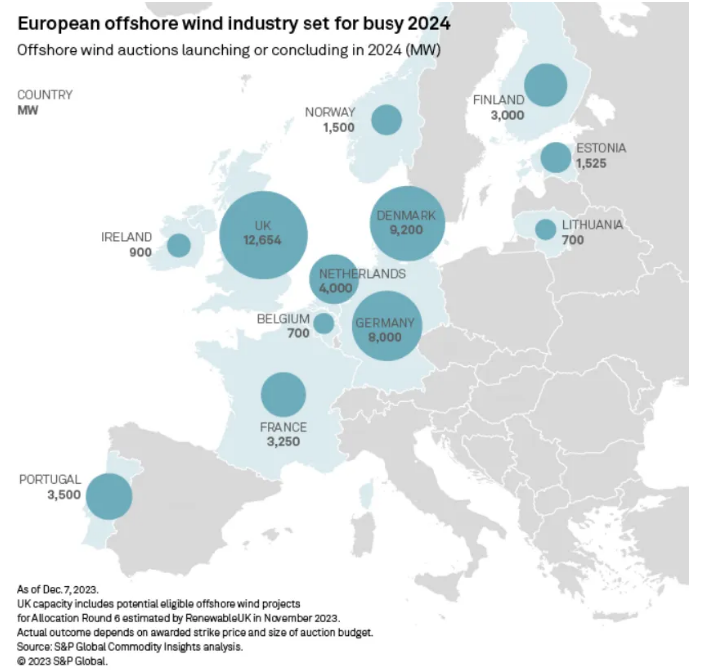

根据标普全球(S&P Global Commodity Insights)的分析,随着各国政府正加倍努力实现2030年可再生能源目标,欧洲国家将在2024年新进行约50GW的海上风电竞标。

该计划横跨北海周边的成熟市场,如英国、德国、荷兰和丹麦,以及相对较新的挪威、爱尔兰和芬兰,这些国家正处于海上风力资源的早期开发阶段。

竞标的目的是在2020年代末或2030年代初达到预期发电规模,帮助欧洲在目前已有的33GW发电能力的基础上,再次对其海上风电机组进行扩大。

2023年,开发商面临了供应链问题和项目成本上升,在经历了多次挫折之后,行业高管认为2024年是欧洲海上风电行业重回正轨的关键一年。

在全球第二大海上风电市场——英国,瑞典公用事业公司Vattenfall AB暂时中止了一个1.4GW项目,在一次承购竞标会上,它甚至未能吸引任何一个海上风电场投标。

英国的一个海上风电场,其政府准备在2024年进行第六次可再生能源竞标。

图片来源:Dan Kitwood/Getty Images News via Getty Images

德国RWE AG公司主管英国和爱尔兰海上风电开发的Danielle Lane说:"我们现在就像在坐过山车。从根本上说,海上风电仍然是一项伟大的事业。欧洲需要它......如果我们要使电力系统脱碳的话。"

RWE于2023年12月买下了Vattenfall的4.2GW诺福克开发区的开发权。

“需要规模”

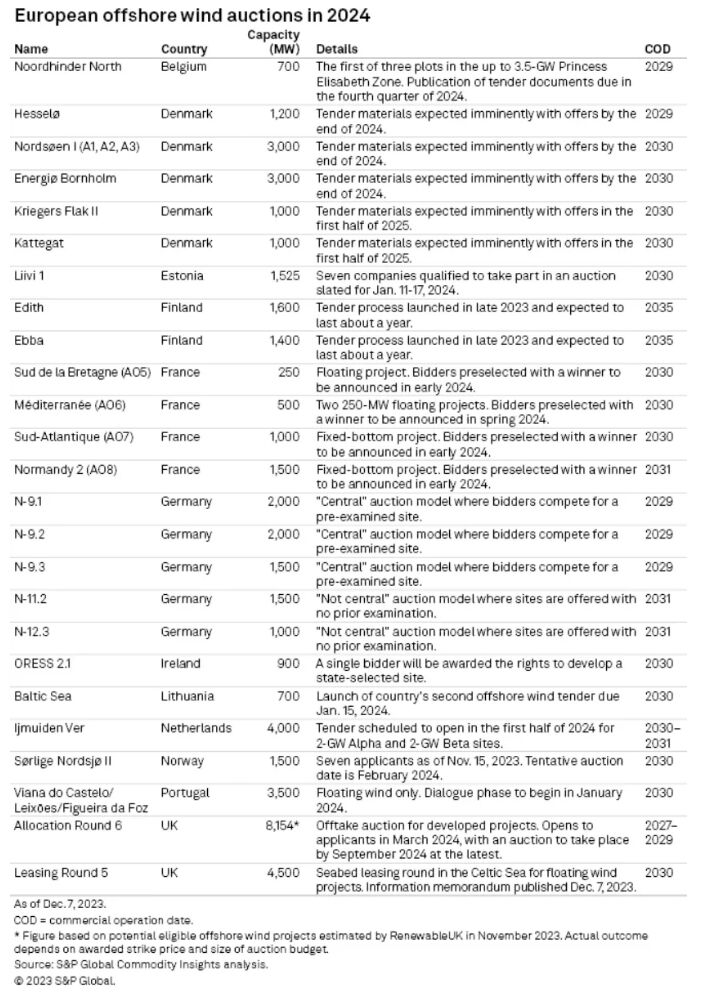

欧洲竞标计划包括将于2024年启动或结束的程序,其中涵盖从早期海底租赁销售到集中竞标和承购合同竞争等各个方面。

其中最受瞩目的是英国的第六次差价合约(CFD)竞标,业界希望这次竞标能弥补2023年一轮竞标的失败。

开发商将失败归咎于在项目成本不断上升的环境下投标上限设置过低。这一结果促使英国政府将2024年的竞标价格上限提高了66%,从2012年44 英镑/MWh的价格提高到了73英镑/MWh。

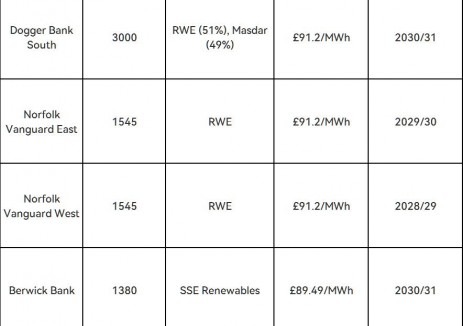

游说团体RenewableUK称,目前有发电量超过8GW的潜在海上风电场有资格参加第六轮分配竞标,其中包括由RWE、Ørsted A/S、Iberdrola SA、SSE PLC和TotalEnergies SE所开发的项目。按当时该团体预计,如果其他开发项目及时获得竞标资格,且Ørsted按计划将2.9GW的Hornsea 3号项目的一部分纳入本次竞标,那么最终的竞标规模可能会更高。

SSE公司高管Lane在2023年11月表示,在经历了上一轮竞标的挫折后,如果英国要在2030年实现50GW的目标,那么随后的两轮海上风电的竞标需要达到10GW到12GW的规模。

Lane表示,结果将取决于CFD预算的规模,该预算必须足够多,以便让潜在产能中的相当一部分可以变为实际产能。

Lane在接受采访时说:"如果只有一个项目成交通过,那么制定(更高的)价格就没有意义了。如果我们要推动供应链更加完善并实现气候目标,那么我们就需要大量产能与规模。"

开辟路径

在欧洲,德国计划在2024年通过招标新增规模达8GW的海上风电发电量。2023年,英国石油公司(BP PLC)和道达尔能源公司(TotalEnergies)在一次规模为7GW的竞标会上同意为这些项目的开发权合计支付126亿欧元。

荷兰将于2024年进行4GW的IJmuiden Ver的竞标,届时也将采取类似的方式。虽然招标要求投标人满足某些非价格标准,但其中也包含财务投标元素,在40年的许可期限内每年上限为4.2亿欧元,即两个2GW的发电站的总价为336亿欧元。

与此同时,丹麦将于2024年启动约9GW的海上风电竞标,涉及五个独立的风电场,前三个风电场的竞标将于2024年底前完成,规模总计约7GW。

丹麦投资机构Copenhagen Infrastructure Partners P/S的首席投资官兼合伙人Martin Neubert表示,虽然对德国、荷兰和丹麦的竞标设计存在一些在所难免的争论,但这些国家同时也拥有 "非常好的海上风电条件(和)非常好的市场"。

在欧洲其他地方,法国将宣布四项独立招标的中标者,包括1.5GW的诺曼底2号和1GW的南大西洋固定底风电场的招标。布列塔尼南部和地中海两个浮动风电项目的招标,也将在短期内宣布中标者。

Engie SA和EDP Renováveis SA的海上风电合资企业 Ocean Winds SL的首席运营官Grzegorz Gorski认为,法国应面向多国进行招标,以帮助政府和开发商降低成本。

Gorski表示,此举还将为该国的海上风电开发领域带来 "可喜的多样化"。在该国之前的八次招标中,国有企业法国电力公司(Electricité de France SA)有五次位列中标财团。

扩博智能,风电业务在全球:

扩博智能已与丹麦、巴西、美国、加拿大、越南、缅甸、泰国、希腊、罗马尼亚、葡萄牙、意大利等不同地区、不同规模的风电厂达成合作,共覆盖29个国家及地区,全球累计巡检80,000+台次,并创下最短巡检时间15分钟、单日陆上巡检记录31台、单日海上巡检记录18台等记录。目前,扩博智能向包括运营商、主机商、叶片制造商、第三方服务提供商等提供全方位的解决方案和服务。在全球各大洲与各主要区域,我们均有专业的智能巡检团队可为您提供一站式服务。

如果您在风电领域有任何想与我们交流的内容、看法与观点,请直接在本公众号后台或文章下方留言!也可邮件至Bob.li@clobotics.com了解更多信息。

英文原文

European offshore wind set for pivotal 2024 as auction road map nears 50 GW

European nations will undertake about 50 GW of new offshore wind auctions in 2024, according to an analysis by S&P Global Commodity Insights, as governments double down on their efforts to meet 2030 renewables targets.

The road map spans established markets around the North Sea, such as the UK, Germany, the Netherlands and Denmark, as well as relative newcomers Norway, Ireland and Finland, which are in the early stages of tapping into their offshore wind resources.

The auctions aim to usher through new capacity for delivery in the late 2020s or early 2030s, helping Europe expand its offshore wind fleet from the more than 33 GW installed today.

Industry executives see 2024 as a pivotal year in getting the sector back on track in Europe after multiple setbacks in 2023, when developers grappled with supply chain issues and the realities of higher project costs.

In the UK, the second-largest offshore wind market globally, Swedish utility Vattenfall AB suspended development of a 1.4-GW project, and an offtake auction failed to attract even a single bid from an offshore wind farm.

"We're on a roller coaster," said Danielle Lane, head of offshore development for the UK and Ireland at Germany's RWE AG. "Fundamentally, offshore wind is still a great business. And Europe needs it ... if we're going to decarbonize our electricity system."

RWE bought the rights to Vattenfall's 4.2-GW Norfolk development zone in December 2023.

'We need volume'

The road map of European auctions includes processes that are due to either launch or conclude in 2024, spanning everything from early-stage seabed lease sales to centralized bidding rounds and competitions for offtake contracts.

Among the most hotly anticipated is the sixth contracts for difference (CFD) auction in the UK, which the industry hopes will make up for 2023's failed bidding round.

Developers blamed the failure on a bid ceiling that was too low in an environment of rising project costs. The result prompted the UK government to increase the price cap for the 2024 auction by 66%, from ?44/MWh to ?73/MWh in 2012 prices.

As it stands, more than 8 GW of potential offshore wind farms are eligible to bid in Allocation Round 6, according to lobby group RenewableUK, including projects developed by RWE, ?rsted A/S, Iberdrola SA, SSE PLC and TotalEnergies SE. The eventual figure could be even higher if other developments receive consent in time and ?rsted bids part of the 2.9-GW Hornsea 3 into the auction as planned, after making a final investment decision in late 2023.

After the setback of the last auction, the UK's two subsequent rounds need to deliver between 10 GW and 12 GW of offshore wind if the country's 50-GW target is to be met by 2030, SSE executives said in November 2023.

The outcome will hinge on the size of the CFD budget, which needs to be big enough to allow a decent portion of the potential capacity to come through, according to Lane.

"There's no point in setting a [higher] price if only one project goes through," Lane said in an interview. "If we're looking at stimulating the supply chain and meeting our climate goals, then we need volume."

Bulging pipeline

In Continental Europe, Germany plans to tender 8 GW of new offshore wind capacity in 2024. In 2023, a 7-GW auction structured with an uncapped financial bidding phase saw BP PLC and TotalEnergies agree to pay a combined €12.6 billion for the rights to develop the projects.

The Netherlands is set to follow a similar path in 2024 when it embarks on its 4-GW IJmuiden Ver auction. While the tender requires bidders to meet certain nonprice criteria, it also features a financial bidding element capped at €420 million per year for the duration of the 40-year permit, or €33.6 billion in total across the two 2-GW sites.

Meanwhile, Denmark will kick-start around 9 GW of offshore wind auctions in 2024 across five separate sites, with bids for the first three, representing about 7 GW, due by the end of 2024.

While there is legitimate debate about the design of the German, Dutch and Danish auctions, the countries also have "very good offshore wind conditions [and] very good offtake markets," said Martin Neubert, chief investment officer and partner at Danish investor Copenhagen Infrastructure Partners P/S.

Elsewhere in Europe, France is expected to announce the winners of four separate tenders that have been in process for some time, including the 1.5-GW Normandy 2 and 1-GW Sud-Atlantique auctions for fixed-bottom wind farms. Two floating wind tenders, Sud de la Bretagne and Méditerranée, are also poised to announce winners shortly.

France should move to multisite awards to help reduce costs for both the government and developers, according to Grzegorz Gorski, COO of Ocean Winds SL, the offshore wind joint venture between Engie SA and EDP Renováveis SA.

Such a move would also bring "welcome diversification" in the country's offshore wind development scene, Gorski said, with state-owned Electricité de France SA having been part of the winning consortium in five of the country's previous eight tenders.

切换行业

切换行业

正在加载...

正在加载...